Not Necessarily…

There are Numerous Factors in play so it really “depends”

Some of These Factors Include:

- Job status, how long have you worked in your current role

- How is the economy, how is your local housing market

- Might your career change or relocate you

- You’re unsure how long you’ll earn as much money as you do today

- Do you have a family or intend to grow one

- You want to spend money on other big things, like travel, education, investments, or a wedding

- What are your dreams and how do they affect your living arrangements

- How much money have you saved or budgeted for buying a home

- Whether you enjoy or are bothered by home maintenance

The Go Greenberg Approach

Our goal is to help clients realize what is best for them through guidance and education. We work hard and voice any opinions you are not considering as well as challenge the ones you are. Steady communication between a Realtor and their Clients is so important to ensure success. A house isn’t only a place to live and call home, it will also be your biggest financial investment to date.

Our hope is that we see clients into homes that fit their needs and budget. Each home is built differently and conditions vary greatly among re-sales. We only want to sell our clients a home that they will love and reside in for many years. When the time comes to sell, we hope it is because their needs and budgets have changed, not because the home causes “grief”.

Go Greenberg works closely with some great local Charlotte lenders who assist in bridging any financial gaps and concerns.

Contact us today, let’s chat about what makes the most sense for YOU!

Think Buying is too Expensive?

You might be surprised.

Did you know that as a first time home buyer, you may qualify for special programs that feature low down payments, easy qualifying, and options to finance your closing costs and pre-paids.

These programs include:– NC Home advantage mortgage (Link to: North Carolina Housing Finance Agency)

– Nc 8,000 special down payment assistance (Link to: North Carolina Housing Finance Agency)

Home Owning

Advantages

- Property builds equity

- Stable/fixed monthly payments

- Claim a tax deduction

- Pride of ownership

- Customize your home how you like (change decor)

- Invest in upgrades and landscaping to increase value

- Flexibility with pet ownership

- May provide a home equity line opportunity

- Zero down payment options

- A “forced” savings plan

Disadvantages

- “Stuck” to one place

- Neighborhood could change

- Changing market conditions

- Responsible for maintenance and repair

- Time consuming tasks

- Financial planning

- Can require more budgeting/homework

- Risk of “investment”

- Can’t control taxes or neighbors

- Equity can go down (deprecation)

Renting

Advantages

- Few maintenance responsibilities

- Can move as you please around terms

- Lower barrier of entry financially

- Fixed cost for term of lease

- Not responsible for home insurance or taxes

- More free time (less work on home chores)

- Not losing equity (in case of depreciation)

- Often more convenient locations in same monthly budget

Disadvantages

- No control over rent increases

- Never gain in equity

- No tax deductions for rent

- Less or little privacy

- Can be “ousted” at end of lease term

- More moving and costs of associated with it

- Landlord can gain entry to property with little or no notice

- Limited or no ability to personlize your home

- Paying someone else’s mortgage

- Lack of pet friendly options

Does it Make Sense to Buy?

Just Because you Want to Doesn’t Mean You Should

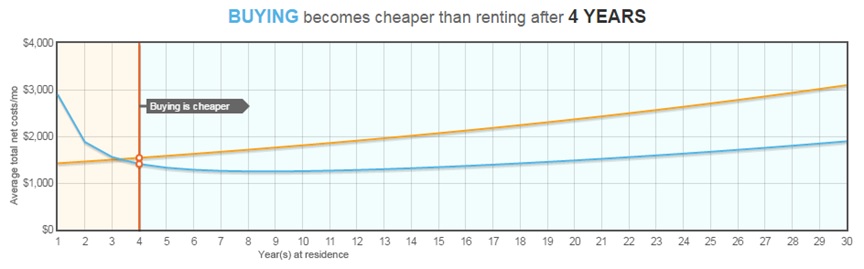

Check out this rent vs buy calculator provided by Realtor.com

You’ll notice that this decision is largely driven by how long you anticipate living in your new home. Other factors and questions are best discussed and answered by Go Greenberg or a trusted lender. Also, it can be beneficial to take into account tougher questions like: How much should you spend compared to what you’re approved for? Is it smarter to buy a “starter home” yet have a plan for moving up at a later time? How likely can your first home become an investment property should you choose?

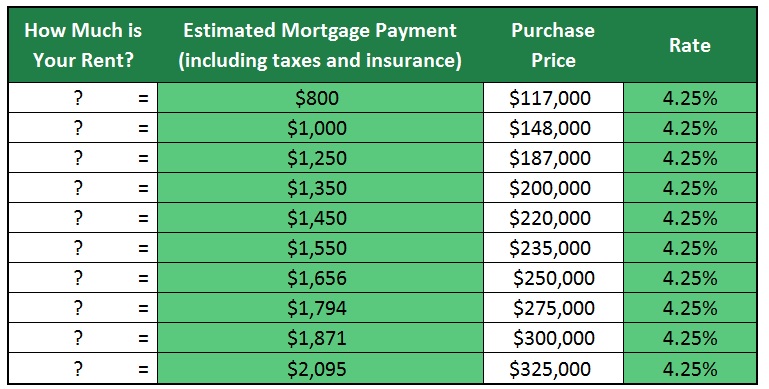

Home Much Home Can I Afford?

A Mortgage Lender Knows Best!

If you’re not ready to contact a lender yet, check out this Affordability Calculator provided by Realtor.com

*Based on FHA 30 year fixed term with 3.5% down. This is an estimate of cost. Rates and terms are subject to change. Please seek tax advice from your CPA. Interest and real estate taxes based on 28% tax bracket.